Trump’s Big Beautiful Bill Passes: What the Senate Actually Changed

Trump’s Big Beautiful Bill just cleared Congress with a razor-thin 51-50 Senate vote—and the amendments reveal a legislative masterpiece of corporate welfare disguised as fiscal responsibility. The CBO score shows the Senate version adds $3.9 trillion to the debt, while Medicaid and SNAP cuts threaten 12 million Americans with lost coverage and trigger massive job losses across states.

Table of Contents

Senate Vote Breakdown and Key Players

The Senate passed the One Big Beautiful Bill Act with Vice President Vance casting the tie-breaking vote after a marathon 24-hour session that broke records for amendment votes. Three Republicans joined all Democrats in opposition: Susan Collins (Maine), Thom Tillis (North Carolina), and Rand Paul (Kentucky), while Lisa Murkowski was the final holdout before agreeing to support the measure.

The bill’s passage came after 45 consecutive amendment votes in the Senate’s longest vote-a-rama in history, with corporate lobbyists working behind the scenes to preserve key tax breaks while social programs faced the knife. The American Petroleum Institute and U.S. Chamber of Commerce spent millions in the final weeks pushing senators to maintain fossil fuel subsidies.

House Democratic Leader Hakeem Jeffries delivered an 8-hour, 44-minute floor speech—the longest in House history—systematically exposing how the bill transfers wealth from working families to corporations. The final House vote was 218-214, with several Republicans flipping at the last minute after White House pressure.

Medicaid Cuts Hit Working Families Hardest

The Senate version accelerates Medicaid work requirements to 2027 and implements provider tax restrictions that will devastate state budgets. Independent analysis shows 12 million Americans will lose health coverage by 2034, with rural hospitals bearing the brunt of closures and service cuts.

The human cost is staggering. Healthcare policy experts project 8,200 to 24,600 additional deaths annually due to reduced healthcare access. States like Kentucky, West Virginia, and Mississippi—ironically, Trump strongholds—will see the deepest cuts to services their residents depend on.

SNAP cuts are equally brutal. The Senate version imposes work requirements on able-bodied adults without dependents, threatening food assistance for 2.3 million households. Food banks are already preparing for increased demand as families lose federal nutrition support.

Corporate Giveaways While Social Programs Burn

While slashing aid for working families, the bill delivers historic windfalls to corporate America. The carried interest loophole preservation alone saves private equity firms $13 billion in taxes, while 100% bonus depreciation allows Fortune 500 companies to write off equipment purchases immediately.

Oil and gas companies secured new subsidies to circumvent the 15% corporate Alternative Minimum Tax, effectively adding billions to fossil fuel profits. The American Petroleum Institute called it “a victory for American energy independence”—translation: taxpayer-funded corporate welfare for already-profitable polluters.

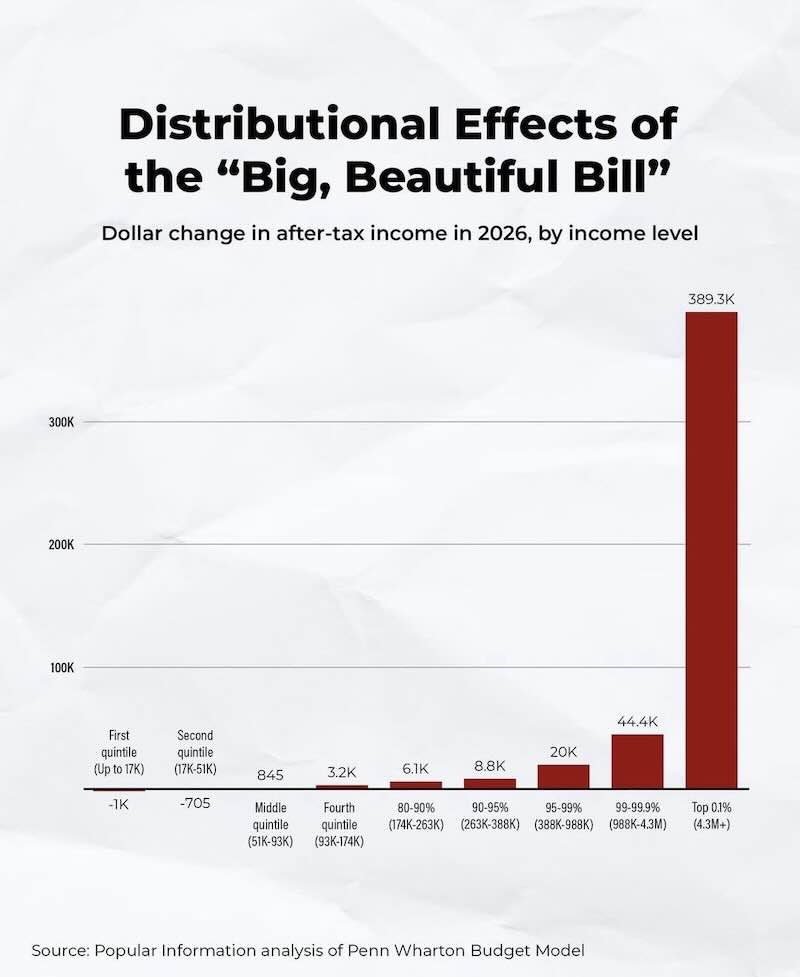

The Institute on Taxation and Economic Policy found that the top 1% of earners receive $1.02 trillion in tax cuts over the next decade, while Medicaid cuts total $930 billion. The math is clear: this bill takes from the poor to give to the rich.

The $3.9 Trillion Deficit Bomb

Despite Republican claims of fiscal responsibility, the CBO’s “current policy” score reveals the bill adds $3.94 trillion to the debt over 2025-2034, including $690 billion in additional interest costs. The deficit impact is nearly $1 trillion larger than the House version.

The bill provides $4.45 trillion in tax cuts while cutting only $1.5 trillion in spending—a $3 trillion imbalance that future generations will pay for. Interest rates on 10-year Treasury bonds are projected to rise 14 basis points, potentially adding over $1,000 annually to mortgage costs for typical homeowners.

Republicans used the controversial “current policy baseline” to mask the true cost of extending 2017 tax cuts, effectively hiding $3.8 trillion in expenses. This accounting gimmick undermines the Senate’s traditional 60-vote requirement and sets a dangerous precedent for future legislation.

Economic Impact on State Economies

The Medicaid and SNAP cuts will trigger a devastating economic domino effect. Research from George Washington University’s Milken Institute shows 1.2 million jobs will be lost by 2029, with state economies shrinking by $154 billion.

The job losses aren’t just in government—they ripple through entire communities. When hospitals close due to Medicaid cuts, local restaurants, shops, and services lose customers. When families lose SNAP benefits, grocery stores see reduced sales, affecting everyone from cashiers to suppliers.

Ironically, the economic damage from benefit cuts ($154 billion) far exceeds the federal savings, creating a net loss for the American economy. States will be forced to either raise taxes or cut services further, creating a vicious cycle of economic contraction.

Frequently Asked Questions

What This Means for 2026 Elections

The Big Beautiful Bill’s impacts will be felt most acutely in 2026, when Medicaid work requirements kick in and hospital closures accelerate. Voters in states like Kentucky, West Virginia, and Mississippi will experience the sharpest cuts to services, creating potential political backlash against Republican senators who supported the bill.

The economic data is damning: 1.2 million job losses and $154 billion in economic damage will be impossible to hide when unemployment rises and local businesses close. Rural hospitals shutting down will affect entire communities, not just Medicaid recipients.

Democratic campaigns are already preparing to highlight the stark contrast: $1.02 trillion in tax cuts for the wealthy while 12 million Americans lose healthcare. The bill’s impact on working families will be the defining issue of the next election cycle.

The Big Beautiful Bill may be beautiful to corporate lobbyists, but it’s a nightmare for everyone else. And voters will remember who made it possible.

Sources

- CBO Score Shows Senate OBBBA Adds Over $3.9 Trillion to Debt – Committee for a Responsible Federal Budget

- How Medicaid, SNAP Cutbacks in One Big Beautiful Bill Would Trigger Job Losses Across States – Commonwealth Fund

- Cuts to Medicaid and SNAP Could Eliminate 1.2 Million Jobs – George Washington University Milken Institute

- Overview of Senate-Passed Version of HR 1 One Big Beautiful Bill Act – PwC

- Senate Passes One Big Beautiful Bill: Comparison of Key Tax Provisions – Reed Smith

- Senate Passes One Big Beautiful Bill Act – American Hospital Association

Have a tip, correction, or want to share your perspective? Contact us here or leave your thoughts in the comments below.